Payroll contribution calculator

Taxes Paid Filed - 100 Guarantee. Ad Payroll Done For You.

Paycheck Calculator Take Home Pay Calculator

To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year.

. Try changing your tax withholding filing status or retirement savings and let the payroll deduction calculator show you the impact on your take home pay. Second many employers provide matching contributions to your account which can range from 0 to 100 of your contributions. Select a State Annual Wage.

Gross Pay Calculator Plug in the amount of money youd like to take home. Taxes Paid Filed - 100 Guarantee. For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly salary while the employer contributes 13.

Your expected annual pay increases if any. Growing a global team. Everything You Need For Your Business All In One Place.

Salary Your annual gross salary. For 2020 the maximum contribution for this type of plan is 19500 per year for individuals under 50 and 26000 for individuals 50 or older. For example if you earn 2000week your annual income is calculated by.

The figures generated are estimates and. People often use this calculator to figure out a new dollar amount they should contribute to reach the IRS limit without going over. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Ad Compare This Years Top 5 Free Payroll Software. Select the pay period of the LES. Employee paid health insurance Health insurance.

Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Use this calculator to see how increasing your contributions.

Select what year you are planning. Ad Modern teams use Remote. In 2022 year-to-date earnings is not required or used.

Using the calculator In the following boxes youll need to enter. This number is the gross pay per pay period. Subtract any deductions and.

As an employer youre. Our employer tax calculator quickly gives you a clearer picture of all the payroll taxes youll owe when bringing on a new employee. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate after-tax wages for hourly employees.

This will tell the calculator what your pay cycle is. But when you change how much youre. Free Unbiased Reviews Top Picks.

Leading EOR offering global payroll benefits and compliance. Typically this is your gross earnings minus employer paid health insurance and any Flexible Spending Account FSA contributions. Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an employer.

Contribution Calc ulator Instructions 1. Ad Easy To Run Payroll Get Set Up Running in Minutes. Ad Easy To Run Payroll Get Set Up Running in Minutes.

Remote is your local expert for international employee benefits. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. Your new paycheck is 000 more.

This calculator uses the withholding. After you have determined that you are an employer a trustee or a payer and have opened a payroll program. For example if an employee earns 1500 per week the individuals annual.

Try changing your tax withholding filing status or retirement savings and let the payroll deduction calculator show you the impact on your take home pay. The Best Online Payroll Tool. How frequently you are paid by your employer.

Ad Compare This Years Top 5 Free Payroll Software. Customized for Small Biz Calculate Tax Print check W2 W3 940 941. Free Unbiased Reviews Top Picks.

The information provided by these calculators is intended for illustrative purposes only. Select your payroll agency. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Changes to the rules for deducting Canada Pension Plan CPP contributions.

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Tax Calculator For Wages Online 56 Off Www Ingeniovirtual Com

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Federal Income Tax Fit Payroll Tax Calculation Youtube

Payroll Calculator Free Employee Payroll Template For Excel

How To Calculate Payroll Taxes Methods Examples More

Payroll Calculator With Pay Stubs For Excel

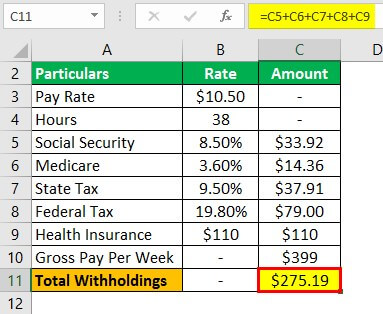

Payroll Formula Step By Step Calculation With Examples

Payroll Calculator With Pay Stubs For Excel

How To Calculate 2019 Federal Income Withhold Manually

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Payroll Calculator With Pay Stubs For Excel

Free 7 Sample Payroll Tax Calculator Templates In Pdf Excel

Payroll Tax Calculator For Employers Gusto

How To Calculate Federal Income Tax

Paycheck Calculator Take Home Pay Calculator

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022